The Indian real estate market has seen numerous ups and downs in the last couple of years. Each time the market sees a low, the sector comes up with unique solutions to push sales and lure buyers. Keeping up with the trend, builders and developers come up with several innovative payment schemes, some of which have become very popular with buyers. A construction-linked payment plan (CLP) is one such scheme.

What is a construction linked plan?

A CLP plan is a payment plan in which, the buyer, builder and the loan/financing company enter a tripartite agreement. The buyer makes an initial payment to the builder. Thereon, the bank/financing company finances the builder with instalments at the completion of pre-determined construction milestones of the project, commonly referred to as slabs.

The final payment is made at the time of completion. During this time, the buyer pays a pre-EMI interest on the home loan to the bank. Once the construction is complete, the buyer starts paying an EMI to the bank/financing corporation.

Are you: First Time Home-Buyer? Know your Payment Options

What are the variations in payment?

• The initial booking amount is usually about 20-25 per cent of the total cost of the apartment. The instalments may vary according to the stage of completion depending on the builder and the project.

• The payment during each slab varies between 15-20 per cent. These charges usually include base price, preferential location charges (if any) and other development charges.

• The final payment includes about 10-15 per cent of the total cost.

• In certain variations of CLP, the buyer makes a booking by paying about 5 per cent of the cost or a lump sum amount and pays about 15-20 per cent within 30-45 days during the agreement. There can also be other minor variations of the CLP.

Also Read: What does Preferential Location Charges mean?

What is the major risk involved?

• Now, while this plan might appear quite attractive to you, there’s a catch. By the time the outer structure is ready, the buyer or the bank has paid 80-90 percent of the apartment’s cost. Next comes the stage, where the interiors and finishes have to be done.

• In an ideal scenario, this stage usually takes anywhere between six months and one year. But it is at this stage that the developer begins to delay the project, stretching it from one to three years or more.

• It has come to light that having collected most of the apartment’s cost, builder often tends to divert the money to other lucrative projects.

What are the advantages and disadvantages?

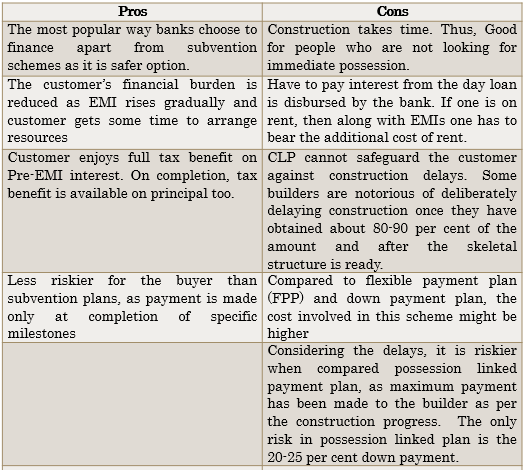

The biggest advantage of a CLP plan is that the customer makes the payment only when the construction is progressing. However, CLP too has its fair share of disadvantages.

What to check?

-Check property prices without the scheme and calculate the difference. Chances are that builder might have already increased the prices.

-Check location of the property and see if the quoted price is justified or not

-Check for relevant approval documents

-Check all the extra costs that you might be liable to pay at the time of possession. There has been instances where developers make certain changes without notifying the buyers and then ask for extra money. Thus, till the time, Real Estate Bill comes into the picture, a due diligent must be carried out in this regard.

-Before signing the deal, read all the terms and conditions carefully. Make sure to check the exit clause and clause pertaining of refund in case the builder stops the construction in future.

Recent Posts